Best Credit Cards for Creators: What’s in My Wallet

Are you looking to learn about the best credit cards for creators that help organize and simplify finances, and maximize rewards? If so, this article is for you! Coming from someone who is a creator but finds credit cards to be confusing, I learned from a pro and sharing my experience with you so you too can learn the top tips in under 5 minutes.

Ready? Let’s do this!

What are the Best Credit Cards for Creators?

Determine Your Primary Business Needs

- Type of Expenses: Are your main expenses related to travel, equipment, office supplies, or advertising? Knowing this will help you choose a card that offers the best rewards for those categories.

- Cash Flow: If your cash flow fluctuates, you might want a card that offers a longer grace period or low introductory APR.

Rewards and Bonuses

- Cash Back vs. Points: Do you prefer straightforward cash back or points that can be redeemed for travel, merchandise, or services?

- Sign-Up Bonuses: Many cards offer sign-up bonuses if you spend a certain amount in the first few months. Ensure you can reach these spending thresholds without straining your finances.

- Bonus Categories: Some cards offer higher reward rates for specific categories, like travel, dining, or advertising spending.

Thanks to my producer German Ceballos (creator behind Airlapse.net) who taught me everything I needed to know about credit cards, flying business class by paying a fraction of the cost, and staying in hotels for free! Before I met German, I’d only opt for cash rewards credit cards because they are the easiest ones to understand.

By the way, if you are sold on a cash-back reward business card, I recommend Capital One Spark Business Cards. For a limited time only, you can get a $500 bonus for each business that opens a new account with my link.

Interest Rates and Fees

- APR: If you anticipate carrying a balance, even occasionally, consider the card’s annual percentage rate (APR). Some cards offer a 0% introductory APR.

- Annual Fee: Determine if the benefits and rewards of the card justify any annual fee. Some cards may waive this fee for the first year.

- Foreign Transaction Fees: If you travel or conduct business internationally, look for a card that doesn’t charge foreign transaction fees.

Additional Features and Benefits

- Travel Perks: These could include free checked bags, airport lounge access, or travel insurance.

- Purchase Protections: Some cards offer extended warranties, theft and damage protection, or even return protection.

- Employee Cards: If you have employees, consider cards that allow you to set spending limits on additional cards and earn rewards from their spending.

There are other features that might also interest you such as:

- Integration with Accounting Tools

- Building Business Credit

- Customer Service

How to Choose the Best Credit Cards for You

While the points made above are important, German also taught me a deciding factor I never thought about before related to travel. It’s not just about if you travel, but also:

- How often you travel: big difference between a single vs. recurring trips

- When you are traveling next: if you have some runway, you can build up points and rewards to plan for a big trip

- Where you are traveling to: It’s easier to plan for domestic travels in North America, even trips to Europe, but traveling to say the Far East or parts of South America isn’t always trivial.

Business and Personal Credit Cards

If you have read any creator finance and taxes articles written on this blog, you probably have heard me say this more than once: as a creator and a small business owner, you must have both business and personal credit cards. And you should always diligently track expenses in these categories.

However, you can combine rewards and points from business and personal cards and use them towards your travel and other needs.

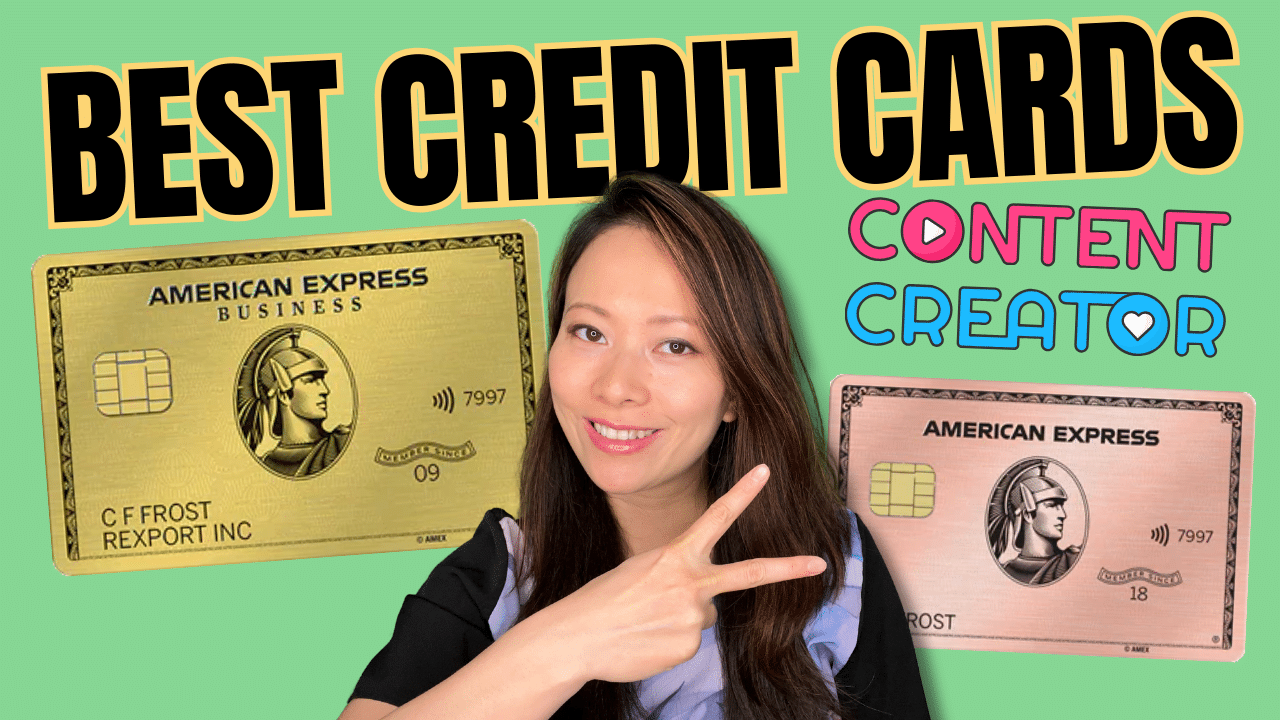

Credit Cards In My Wallet Now (Highly Recommend)

Now that we’ve established some ground rules, here are my top two credit cards sitting in my wallet as a creator and a small business owner.

AmEx Business Gold Card

You can earn up to 70,000 Membership Rewards® points after they use their new American Express® Business Gold Card to make $10,000 in eligible purchases within the first 3 months of Card Membership. Your friend will be able to choose from all available American Express Personal and Business Card offers. No matter which Card they choose, you could earn a referral bonus.

AmEx Gold Card (Personal)

You can earn up to 60,000 Membership Rewards® points after they use your new Card to make $4,000 in purchases within the first 6 months of Card Membership. You will be able to choose from all available American Express Personal and Business Card offers. No matter which card they choose, you could earn a referral bonus.

Conclusion: AmEx Business and Personal Gold Cards

Having AmEx Business and Personal Gold Cards together helps me maximize my rewards and be able to manage my business and personal finances under one roof. I find AmEx’s website and mobile app to be easy to use. As always, I choose to pay my credit card statement in full each month to avoid any interest charges while maximizing my rewards.

Perhaps my biggest lesson learned through this experience is to be open to learning, including credit cards (which historically hasn’t been a favorite subject of mine).

For creators and small business owners, choosing the right credit card is like adding a handy tool to their financial toolkit. A good business credit card not only helps in effectively managing cash flow during unpredictable revenue periods but also paves the way for building a robust business credit profile. Plus, the perk of earning rewards on purchases can be a delightful bonus!

The best cards simplify expense tracking, ensuring business and personal finances don’t mix—saving headaches during tax time. Additionally, in unexpected situations, it’s reassuring to have a financial cushion. And let’s not forget the extra benefits, from purchase protections to empowering employees with their own cards for business expenses, all while keeping a close watch on their spending. In short, the right credit card can be a small business’s best financial companion.

What do you think of these recommended cards? And what’s in your wallet as a creator? Please let me know in the comments below.